Lab on Dynamic Discrete Choice

03 January, 2023

- Consider a simple saving problem (cake eating)

- Explain Bellman problem without uncertainty

- Explain Bellman problem with uncertainty

- Solve simple consumption saving problem

- Simulate transitory and permanent policies

- Plot a fit using some simple distance, an indirect inference estimator

We consider here discrete choices over a set of alernatives. The utility of the agent is modeled as

Cake eating

Imagine you a given a cake os size \(S\), and you need to decide how much to eat everyday. How would you formulate the problem?

\[ \max_{c_t} \sum_{t=0}^\infty \beta^t u( c_t) \quad s.t. \quad \sum_{t=0}^\infty c_t \leq S\] One can write the Lagrangian of this problem and find:

\[L = \sum_{t=0}^\infty \beta^t u( c_t) - \lambda \Big( \sum_{t=0}^\infty c_t - S \Big)\]

and when the error term is type 2 extreme value. This gives the following FOCs:

\[ \beta^t u'(c_t) = \lambda \]

Consider a CRRA utility function \(u(c)=\frac{c^{1-\gamma}}{1-\gamma}\) which gives $ u’(c)=c^{-}$ and hence \[ \sum_{t=0}^\infty c_t = \sum_{t=0}^\infty \Big( \frac{\lambda}{\beta^t} \Big)^{-\frac{1}{\gamma} } = \frac{\lambda^{-\frac{1}{\gamma}}}{1-\beta^{1/\gamma-1}} =S \] hence we get that the consumption will be

\[c_t = \Big( \frac{\lambda}{\beta^t} \Big)^{-\frac{1}{\gamma} } = (1-\beta^{1/\gamma-1})\beta^{t/\gamma}S\]

We can easily plot this for different values of \(\beta\) and \(\gamma\)

library(data.table)

library(ggplot2)A recursive formulation

Let’s introduce \(V(S)\) as the present value, the life time value of having a cake of size \(S\) today and consuming optimally in the future.

\[V(S) = \max_{c_t} \sum_{t=0}^\infty \beta^t u( c_t) \quad s.t. \quad \sum_{t=0}^\infty c_t \leq S\] But note that

\[V(S) = \max_{c} u(c) + \beta V(S-c) \]

The bus engine problem

Imagine that we want to model the decision to replace the engine on in a fleet of buses.

- the state is \(x_t\), the mileage of the bus

- every period, the bus delivers profit as a function of \(x_t\), call it \(p(x_t)\)

- the bus owner Mr Zurcher, can decide to replace the engine at cost \(C\) in which case \(x_t\) goes back to \(0\)

- the bus dies with probability a function of \(x_t\) in which case the owner gets \(0\)

- the owner discounts at rate \(\beta\)

Using our Bellman tool we can write the optimal decision for this problem recursively:

\[ V(x) = \max \{ p(x) + \lambda(x)\beta V(x+u) , -C + \beta V(0) \} \] We can see that this will have a threshold property. In practice the decision won’t be as clear as a simple threshold. We want to allow for some randomness. We then add a logit preference shock \(\xi\) to the different between the two options. We then remember that we can transform the max into a log-sum-exp.

\[ V(x) = \log\Big( \exp \Big[p(x) + \lambda(x)\beta V(x+u)\Big] + \exp \Big[ -C + \beta V(0) \Big] \Big) + \gamma \]

There is not hope to solve this problem in closed form. We tackle it numerically.

n = 100

V = rep(0,n)

x = seq(0,100,l=n)

lambda = 1/(1+exp(0.1*(x-50)))

beta = 0.9

C = 2

P = exp(-0.01*x)

In = c(2:n,n)

rr = data.frame()

for (i in 1:300) {

rr = rbind(rr,data.frame(x=x,V=V,rep=i,v1=P + lambda*beta*V[In],v2=-C + beta*V[1] ))

V2 = log( exp( P + lambda*beta*V[In]) + exp(-C + beta*V[1] ) ) + 0.56

dist = mean((V2-V)^2)

V=V2

}

rr = data.table(rr)

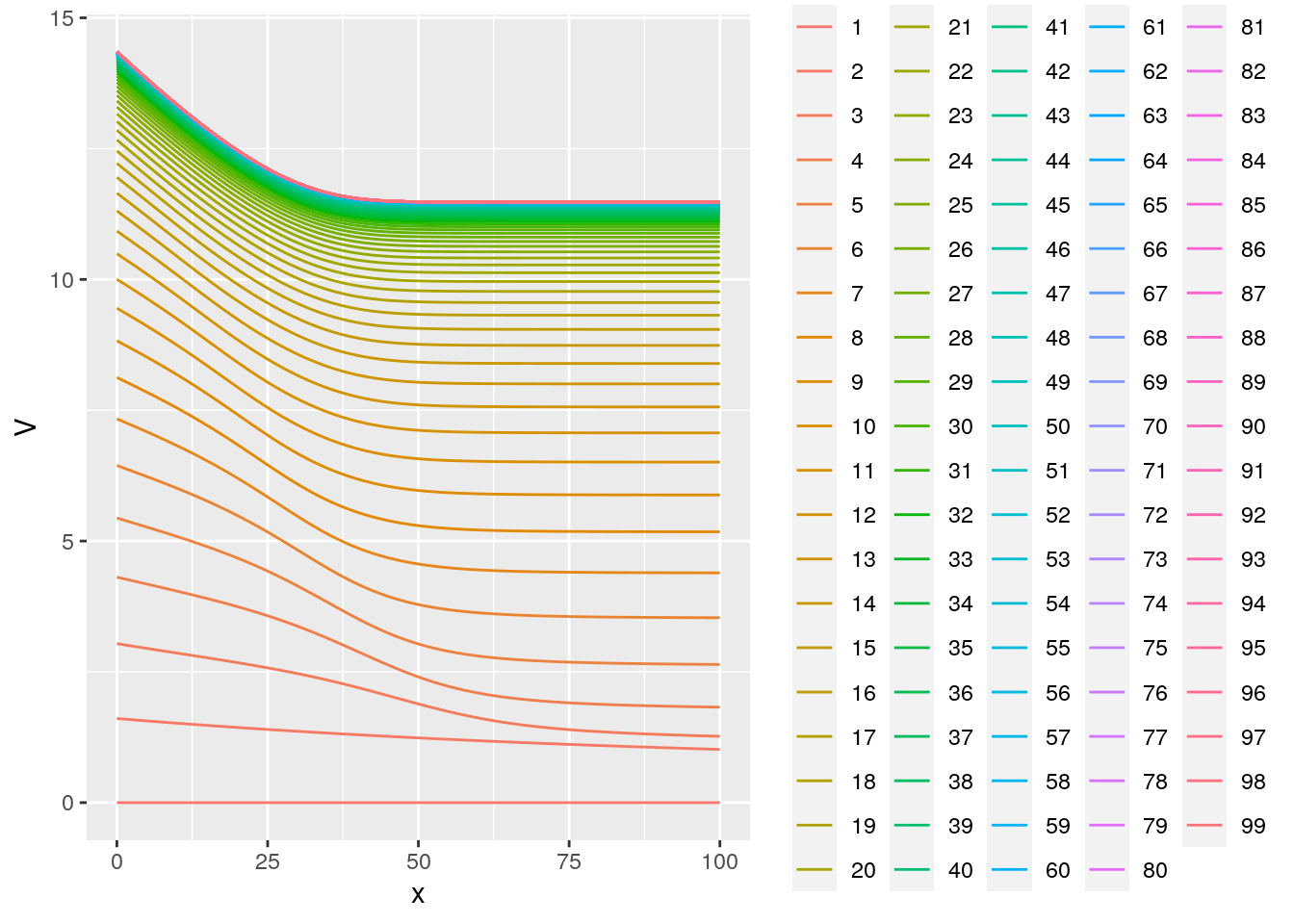

ggplot(rr[rep<100],aes(x=x,y=V,group=rep,color=factor(rep))) +

geom_line()

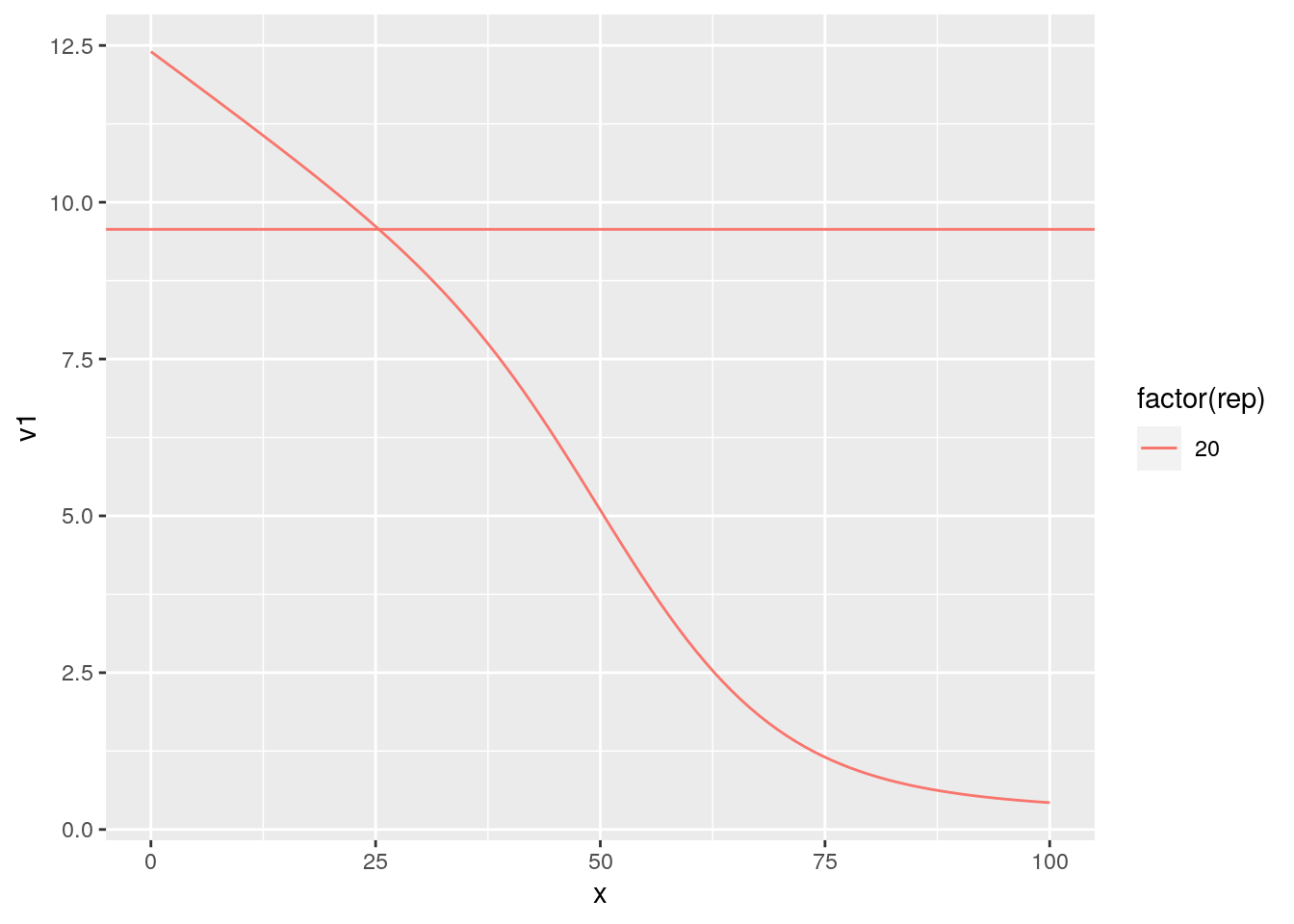

ggplot(rr[rep==20],aes(x=x,y=v1,group=rep,color=factor(rep))) +

geom_line() +geom_hline(aes(yintercept =v2,color=factor(rep)) )

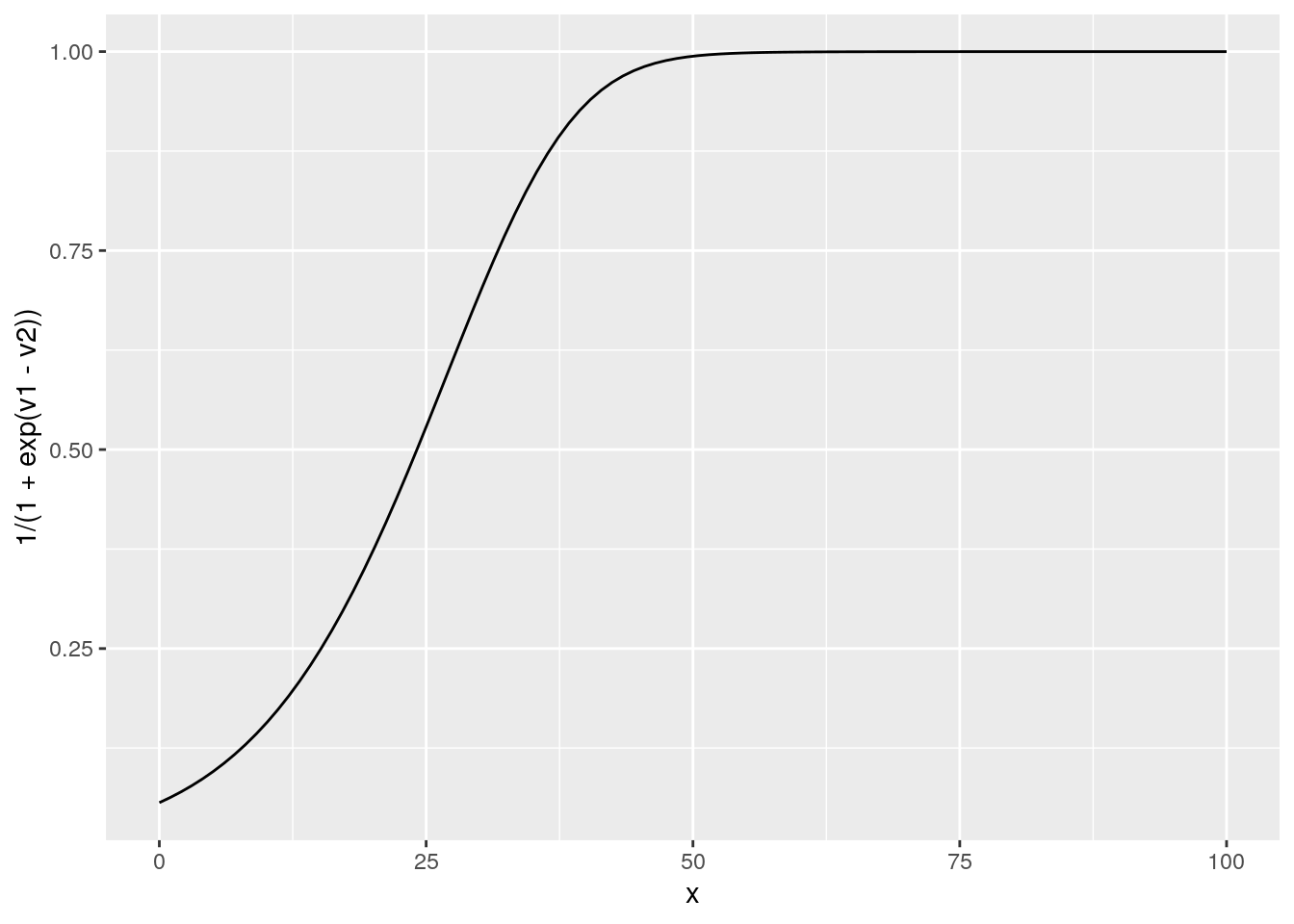

# we can look at the probability to replace

rr2 = data.frame(x=x,V=V,rep=i,v1=P + lambda*beta*V[In],v2=-C + beta*V[1] )

ggplot(rr2,aes(x=x,y=1/(1+exp(v1-v2)))) + geom_line()

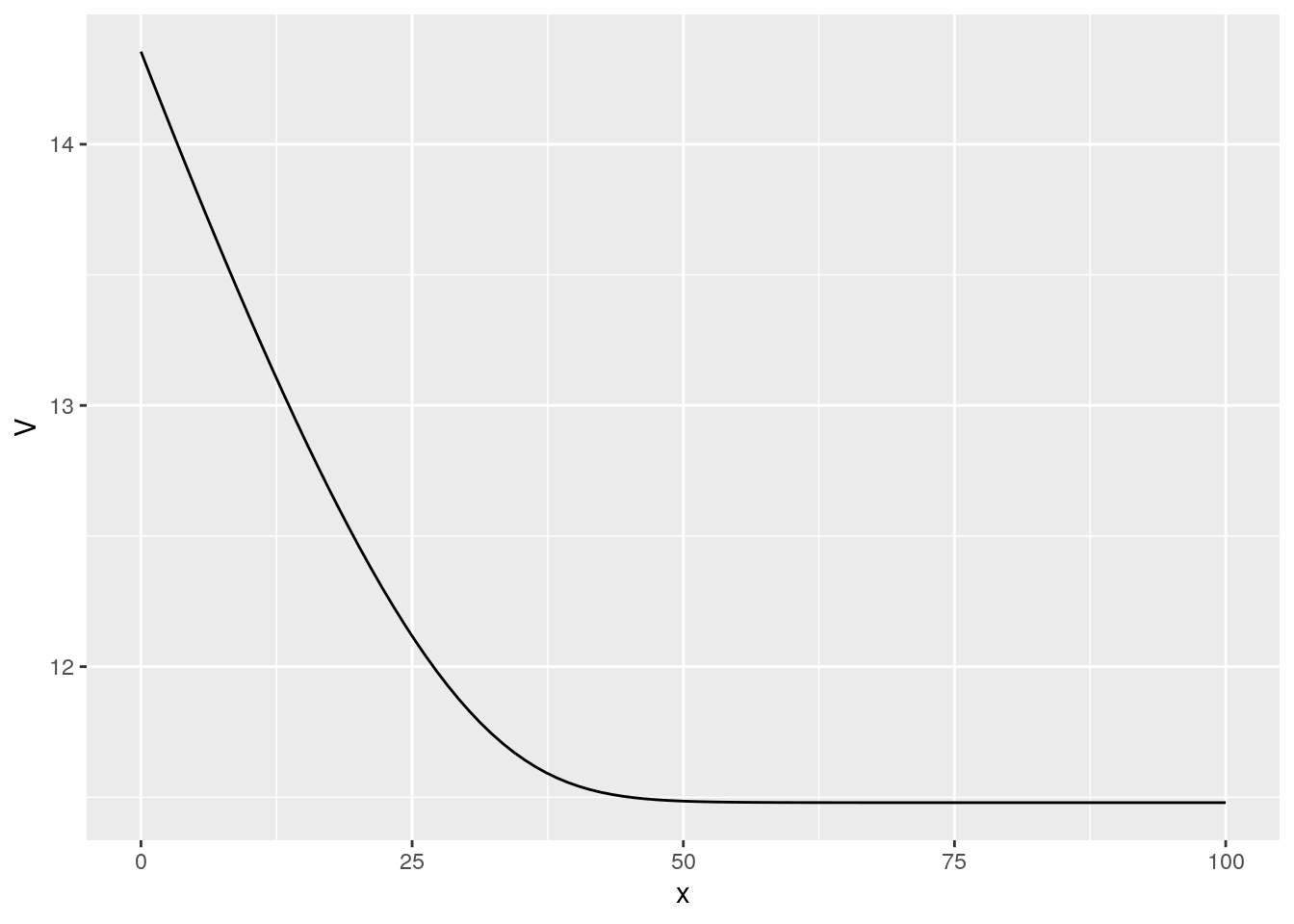

ggplot(rr2,aes(x=x,y=V)) + geom_line()

simulating data

PR1 = 1/(1+exp( P + lambda*beta*V[In] - (-C + beta*V[1])))

rr = data.frame()

for (i in 1:100) {

rrr = data.frame()

x=1

l=1

R=0

for (t in 1:100) {

if (l==0) {

rrr = rbind(rrr,data.frame(i=i,t=t,x=0,l=0,profit=0,R=0))

next

}

# draw the maintenance choice

if (PR1[x]>runif(1)) {

R=1

profit = -C

} else {

R=0

profit = P[x]

if (lambda[x]<runif(1)) {

l=0

}

}

rrr = rbind(rrr,data.frame(i=i,t=t,x=x,l=1,profit=profit,R=R))

if (R==1) {

x=1

} else {

x= x+1

}

}

rr = rbind(rr,rrr)

}

data = data.table(rr)

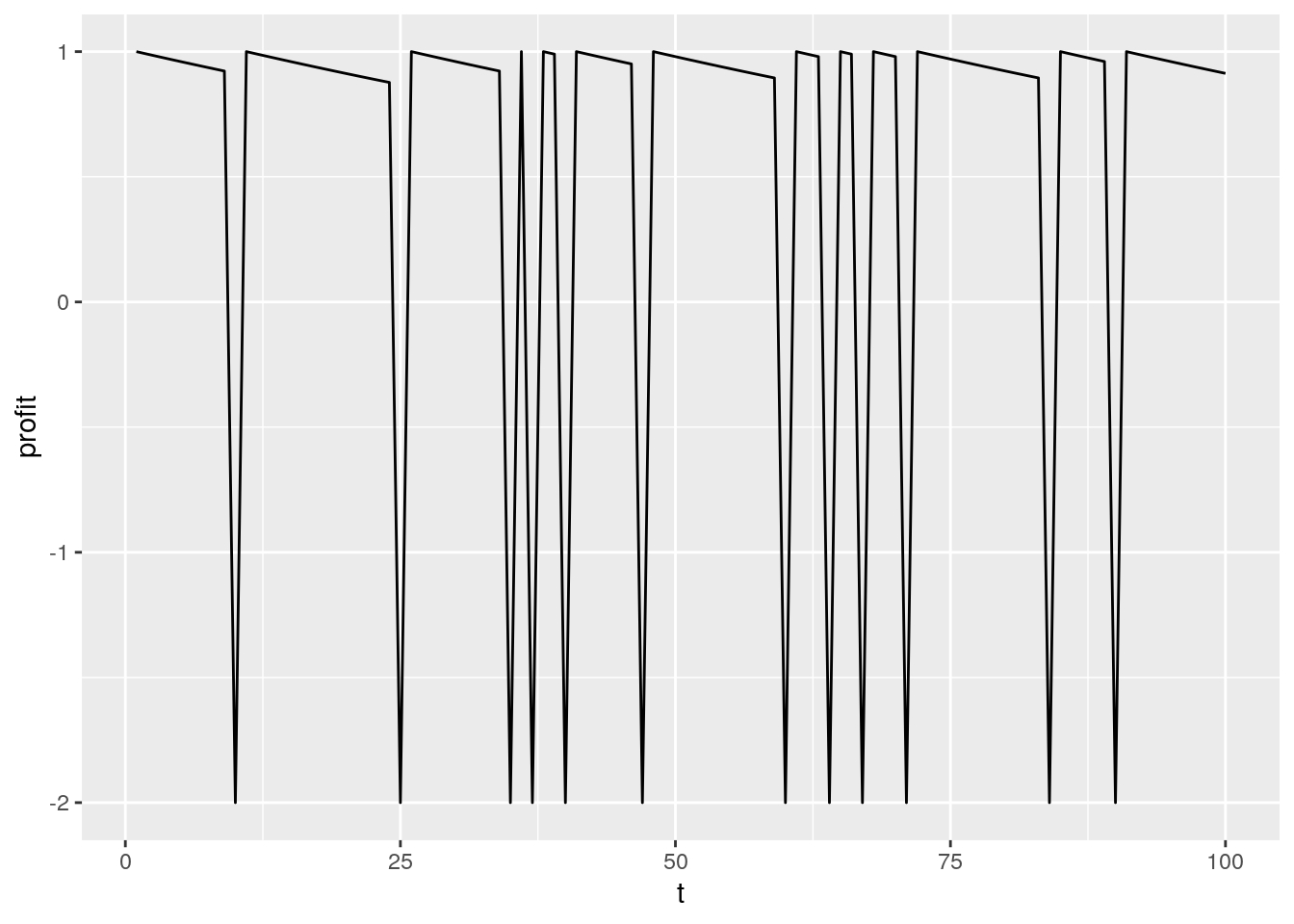

data[,sum(l==1),i][,mean(V1)]## [1] 59.12ggplot(data[i==5],aes(x=t,y=profit)) + geom_line()

Writing a likelihood

We can write the likelihood of the decision and miles and sum accross individuals

lik <- function(theta) {

n = 100

V = rep(0,n)

x = seq(0,100,l=n)

lambda = 1/(1+exp(0.1*(x-50)))

beta = 0.9

C = theta

P = exp(-0.01*x)

In = c(2:n,n)

rr = data.frame()

for (i in 1:100) {

rr = rbind(rr,data.frame(x=x,V=V,rep=i,v1=P + lambda*beta*V[In],v2=-C + beta*V[1] ))

V2 = log( exp( P + lambda*beta*V[In]) + exp(-C + beta*V[1] ) ) + 0.56

dist = mean((V2-V)^2)

V=V2

}

Pr =1/(1+exp( P + lambda*beta*V[In] - (-C + beta*V[1])))

data[l==1,sum(log(Pr[x])*(R==1) + log(1-Pr[x])*(R==0)) ]

}

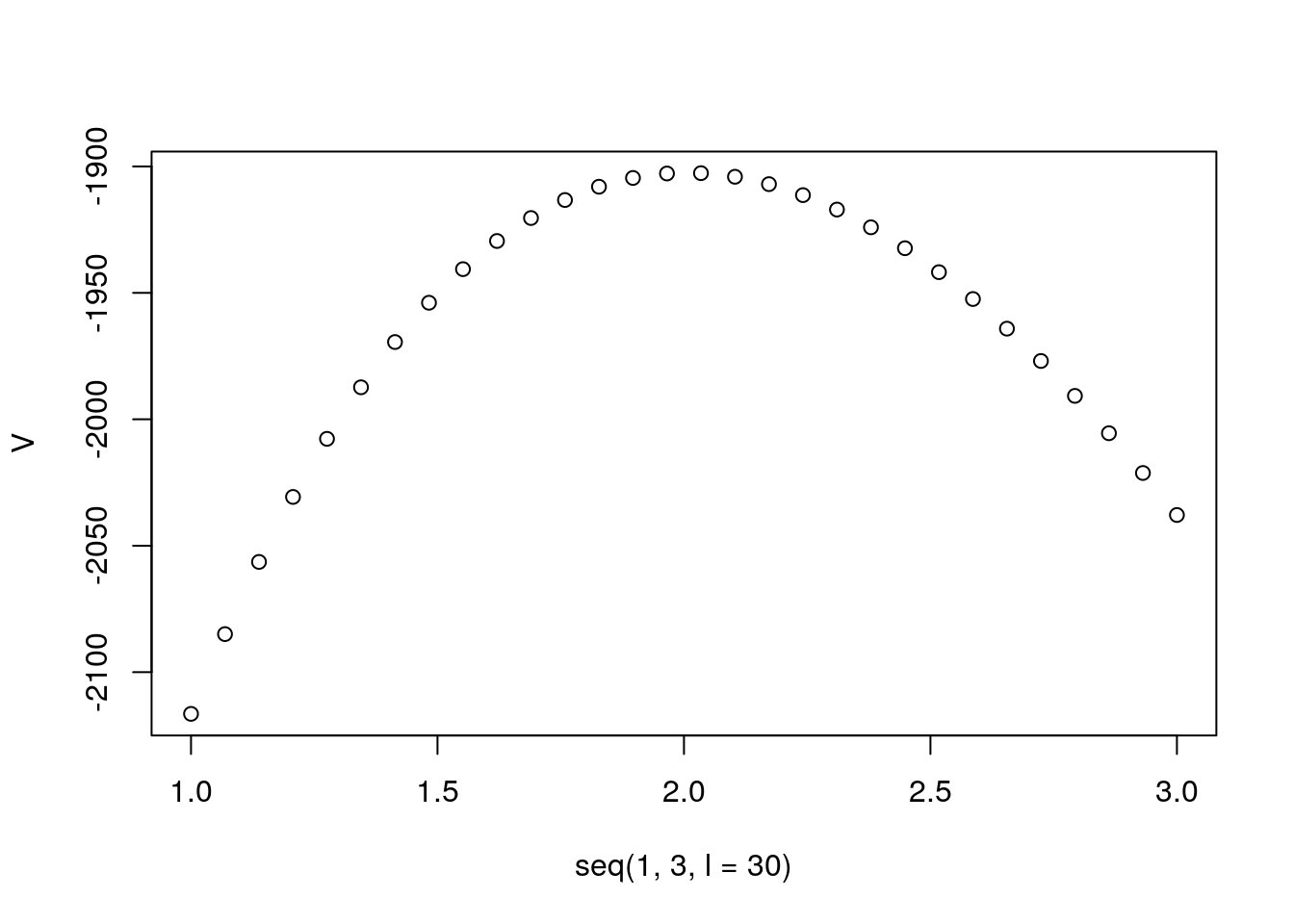

V = sapply(seq(1,3,l=30),lik)

plot(seq(1,3,l=30),V)